from Report of Financial Literacy Task Force 2011

.

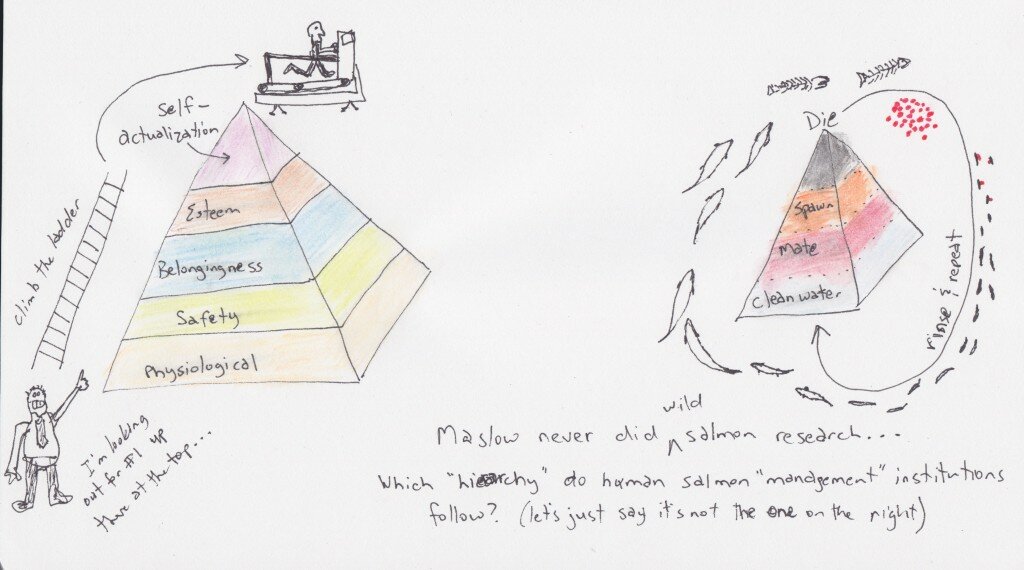

Fascinating sometimes how synchronicity works…

Earlier today I was visiting various news sites as the announcement came out of Toronto from former investment banker and broker (30+ years) and executive director of the Ontario Securities Commission, now Canada’s Natural Resources Minister Joe Oliver:

The federal government is asserting its control over pipelines – including the proposed Northern Gateway oil-sands project – taking from regulators the final word on approvals and limiting the ability of opponents to intervene in environmental assessments.

In proposed legislation unveiled by Natural Resources Minister Joe Oliver on Tuesday, the Harper government will clear away regulatory hurdles to the rapid development of Canada’s natural resource bounty…

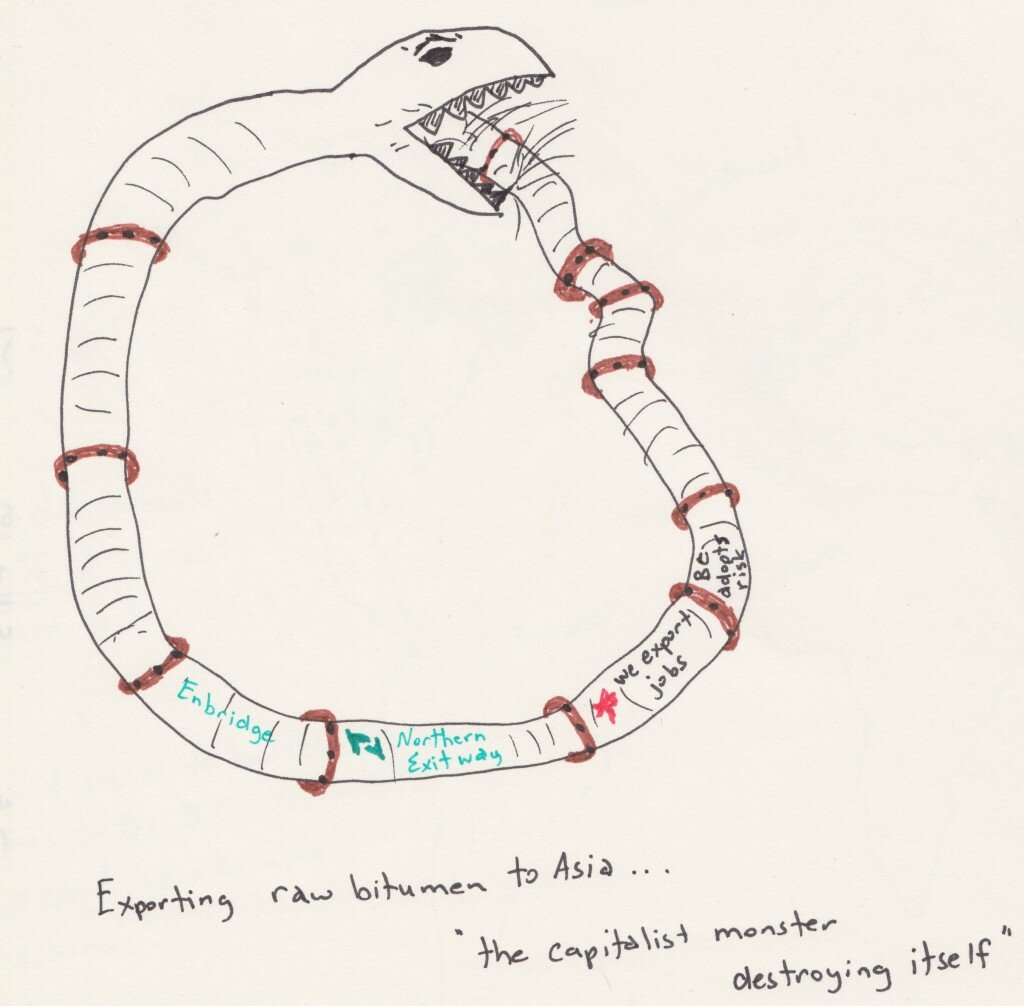

Apparently in Oliver, Harper and the rest of the Reform Gang’s brilliance:

At a Toronto press conference, Mr. Oliver said the proposed changes are aimed at providing quicker reviews in order to reduce regulatory uncertainty and thereby create more jobs and investment in Canada’s booming resource sector.

“We are at a critical juncture because the global economy is now presenting Canada with an historic opportunity to take full advantage of our immense resources,” he said. “But we must seize the moment. These opportunities won’t last forever.”

Hmmmm. They won’t last forever?

Why?

Where are the resources going?

Is this like one of those childhood mythologies… remember “digging to China”? Maybe the Chinese are digging to Canada… stick a siphon in, suck it out…

Oh wait… they don’t have to… just give PetroChina (Chinese government owned company) and let them dig IN Canada…

… and make the siphon out of pipelines and supertankers… (and leave the risk with BC’ers and the BC coast)

_ _ _ _ _ _ _ _

Is this one of those classic, rape it all now and leave little for the future…scenarios?

Hmmm. Who benefits from this approach?

Oliver’s long time buddies in the investment industry, maybe…?

How about my kids? yours?

Nope. NOT.

_ _ _ _ _ _ _ _

And, yet, on the Globe and Mail website earlier today ran the article above as the top story (circled in red below)… and then coincidentally enough, a few hours later the website looks like this:

Globe and Mail screenshot April 17

.

“Household debt is biggest domestic risk” says Bank of Canada.

Canadians’ household debt levels are already at near-record levels. The Bank of Canada thinks they will swell even higher.

“Household spending is expected to remain high relative to GDP as households add to their debt burden, which remains the biggest domestic risk,” the central bank said Tuesday as it boosted its economic growth forecast and indicated higher interest rates are on the way.

Hmmmm. The biggest “domestic” risk in Canada is household debt?

How ’bout the brainwaves running Ottawa these days?

Get that oil out of the ground as fast as possible and send it to resource-hungry growing economies…

what about keeping it in the ground for now and making our next generation, and the generation after that some of the richest going…?

It’s like the brainwave approach occurring right now in sucking out, and sending away Canada’s natural gas resource… at historically low prices.

Natural gas prices have probably never been lower.

yet, suck and send. suck and send. suck and send.

Can’t stop the sucking…

_ _ _ _ _ _ _

Household debt?

It is a shocking problem.

This graph, below, comes from the Federally appointed .

Appointed by current Finance Minister Jim Flaherty, the Task Force completed their Final Report in early 2011. (that is where the image at the beginning of the post comes from).

Here’s their graph showing the levels of household debt in relation to income.

Ratio of Household income to debt ratio over since 1990...

Yea, in a little over 20 years we’ve gone from 90% income to debt, to a soaring 150% now… that’s a problem.

You drive through a town like Prince George recently?…

Some will suggest that all of these households can have RV’s, travel trailers, a couple of vehicles, ATVs for summer and snow machines for winter, and trailers to haul them, and trips to Maui… and… and…

…because the cost of housing is so low.

Apparently, that’s the reason say many…

Well, not one to burst too many bubbles… it’s called debt. Massive Debt.

It’s called, ‘gotta job… sure i’ll give you credit’…

‘shitty credit rating? oh no worries we’ll just charge you more interest’

wanna home, shitty credit, no worries, we got a deal for you…

(not our problem anyways… we’ll just bundle the debt into some obscure financial derivative and sell it to American banks, they’ll get bailed out by taxpayers anyways…)

As the old saying goes: “any turkey can make a payment…”

Not meant to be demeaning, simply a common saying.

With credit available from pretty much any store, retailer, car dealer, and so on… it’s not difficult – in the least – to finance an appearance of “wealth”, “prestige” or “happiness”…

_ _ _ _ _ _ _

So let’s put these two, possibly disparate ideas together…

The current governing regime is going to rip all of our current ‘resources’ out of the ground… and send them to the hoover-resource vacuum cleaner across the Pacific…

“But we must seize the moment. These opportunities won’t last forever.” says Joe.

Oliver that is.

Investment banker… errr… I mean Natural Resources Minister.

I’m sure in his 30+ years in his previous line of work he had little interaction with oil execs, or huge investment funds buying into oil companies… ‘positive’…

And so apparently the Conservatives are ‘streamlining’ environmental regulations in Canada because we must carpe diem. [Seize the Oil…]

[…so we don’t Cease the Economic boom.]

… And YET… and Yet…

50% of Canadians struggle with simple tasks involving math and numbers.

42% of Canadians struggle with reading.

So really… mr. Oliver…(and Harper) who’s going to benefit from this ‘streamlining’ process, this ‘hurry and get the oil out’ process…?

The investment community, or the 50% of Canadians struggling with simple tasks involving math and numbers… yet, simple access to credit… at super low interest (i’m sure)…?

What an interesting time in Canada’s path… from peacekeepers to oil-mongers.

In other words… from ‘whoops, sorry, excuse me… to “What’s your problem? $15 billion for F-35s, $25 billion…? who cares, who’s counting?” (and really it was just this silly accounting error… stop hassling me…)

Someone stop that SCREECH of the record needle as it slides off the old vinyl…